ACH Payments (E-Check) FAQ

For our Premium customers, using ACH or "E-Check" payments can save you over $1,000 each month.

With events often being thousands of dollars, credit card processing fees can add up fast!

Even with good processing rates on your POS of around 2.2%, on a $5,000 event, you will be paying $110 to the credit card processor.

Here's how you can cut your credit card processing fees by 90% or more!

Skip to: How to Enable ACH Payments in Stripe

Skip to: How to Collect ACH Payments from Guests

What are ACH Payments?

ACH stands for "Automated Clearing House" and is essentially an electronic check that goes from a customer's bank to your bank. Similar to checks, they are very low cost because the money is going directly from one bank account to another and there is no money going towards Visa, Airlines, Rewards, etc.

In the past, ACH Payments were hard to implement.

- Customers often had to enter their bank account and routing number to make the payment. Most customers either didn't have this information readily available or weren't comfortable sharing their banking information.

- The other problem with this approach is that there was no way for the customer to visually see if they had enough funds in their bank account before making the payment, increasing the odds of running into an insufficient funds issues.

Now, ACH Payments are easy.

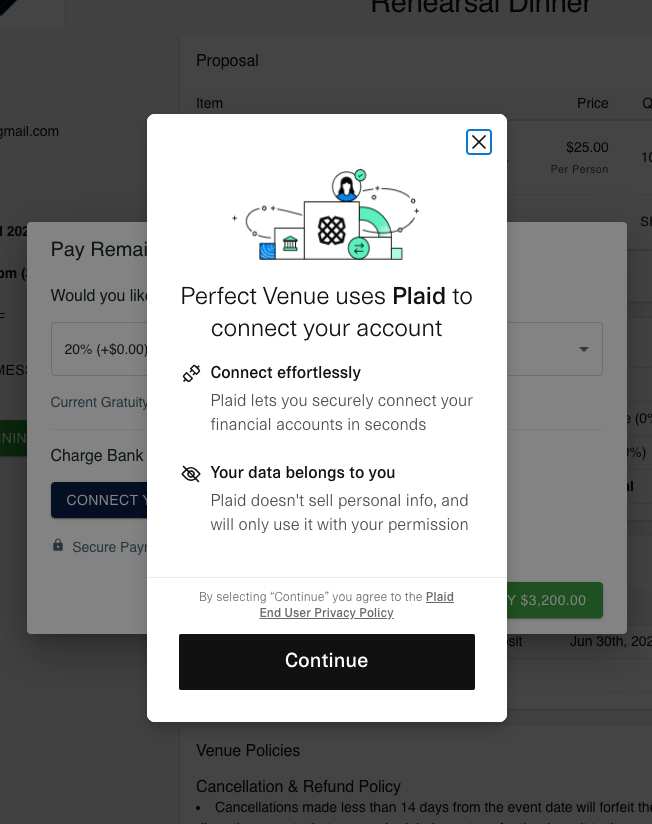

With Perfect Venue, we integrate with a company called Plaid that solves this problem. Plaid is one of the largest companies you've probably never heard of - they are used by Venmo and American Express.

With Plaid, customers can simply log in directly to their bank account directly when making a payment (see below). Most customers have their bank login auto-fill on their computer which makes logging in trivial.

Next, the customer selects the bank account and can view the balance before making the payment which nearly eliminates the possibility of an insufficient funds issue.

Why ACH Payments are great for events

For most everyday payments, ACH payments don't make sense. A guest is looking to simply swipe their card and walk away. Since this is such a quick transaction, you need to instantly know if they have enough funds for the purchase. The credit card fees don't make as much of an impact for a smaller purchase.

Events, on the other hand, are very different. The guest usually makes a deposit months before the date, it's a large sum of money, and they are not rushed like they are in-person. Below is a table to visualize the differences.

Normal Payments vs Event Payments

|

||

| Everyday Payment | Event Payment | |

| Payment Size | ~$50 | ~$5,000 |

|

Processing Fees (Assuming 2.2% + 20 cents) |

$1.30 | $110.30 |

| When Payment is Made | Instantly | Months in advance |

| Process | Instant - Swipe and go | Online - Not rushed |

Drawbacks of ACH Payments

Like with any payment method, there are always drawbacks. The primary drawback of ACH payments is that you don't instantly know if they have the funds on hand to settle the transaction - very similar to a check. So, you wouldn't want to use it to charge the remaining balance the night of an event if you have no way to easily follow up if the charge doesn't clear.

The best way to mitigate this issue is to collect as close to the final amount as possible a few days before the event so that the funds have already been transferred by the time of the event. You can then charge a card for any remaining additions to their tab, but hopefully, the bulk of the event amount will have been paid over ACH.

Each venue is unique, so it really just depends on what is best for you!

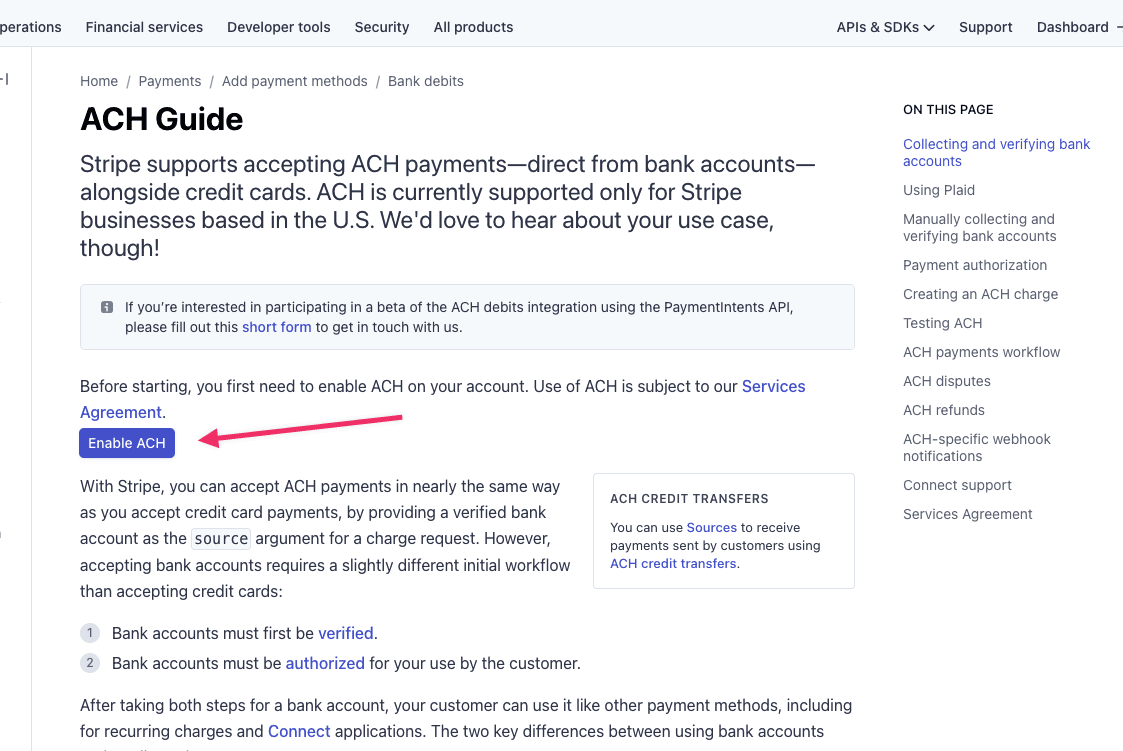

How to Enable ACH Payments in Stripe

Step 1: Enable ACH Payments in Stripe

- Go to: https://stripe.com/docs/ach

- Look for a big "Enable ACH" button. This needs to be selected to enable.

- If you scroll down and do not see the "Enable ACH" button - you have already completed this step (or Stripe already did it for you)

Step 2: Increase your ACH limit if processing payments greater than $6,000

- Go to: https://support.stripe.com/?contact=true

- In the Contact Us box, select "Other" from the dropdown

- Then start a chat conversation by copy-pasting this into the conversation: "Hello, I plan to process ACH payments over $6,000 for my business and want to see what the ACH payment limit is for my account?". Ask them to increase it if necessary.

How to Collect ACH Payments from Guests

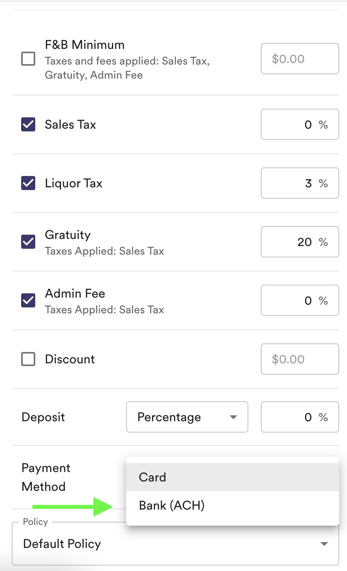

- Head to the event you need to take payment in, and toggle to the proposal tab

- Click "edit" next to total, and scroll to the bottom of the side bar

- You will see a "payment method" drop down, click on this and select "Bank (ACH)"

- Be sure to scroll back to the top and hit "save!" Your guest will now be able to pay with ACH.

If you have any other questions, shoot us an email support@perfectvenue.com!