Taxes + Fees FAQ

Taxes and Fees can be edited at any time, but there are some important things to note when doing so.

The way taxes and fees are calculated in Perfect Venue are off the actual menu items, and not subtotals. So, you always want to be sure menu items have the taxes and fees you would like checked off.

Adding or Editing a Tax or Fee

When adding or editing a tax or fee, it will only apply to future events coming into the system, and not events that have already been created.

The Totals in an event will give a notice when the taxes and fees do not match the settings, and also give you an option to adjust the current event to the defaults.

When you add a new tax or fee, it will not automatically apply to menu items, so you will need to go through your menu settings to check the new tax/fee off on menu items.

To do so, click on the menu item, check off the new tax or fee, and hit “save.”

To do this in bulk, click into a menu section:

Select the new tax or fee and click the "Apply these taxes and fees to all items in this category"

All menu items in this menu section will not have the new tax or fee applied.

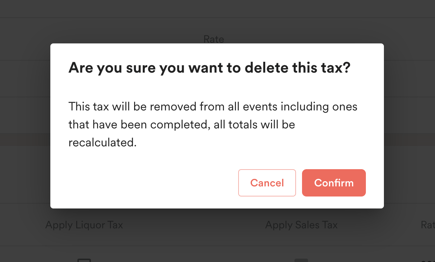

Deleting a Tax or Fee

If you want to delete a tax or fee in settings, it will delete from everything in the system, including completed events.

How do I change a tax or fee per event?

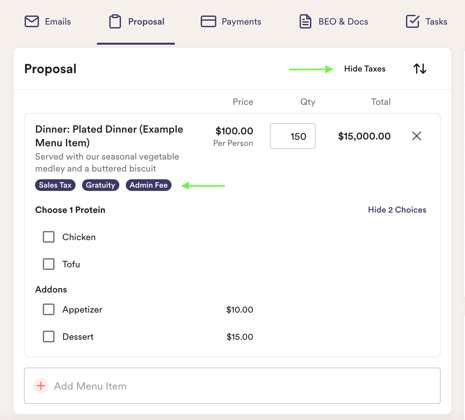

Your taxes and fees settings are defaults. Each tax and fee and percentages can be toggled on or off in a proposal, and you are also able to change each percentage per event. Simply hit “edit” next to totals, and adjust from there!

Why aren’t my taxes and fees aren’t adding up correctly in my proposal?

Because our taxes and fees are calculated off each menu item, and not off of subtotals, always be sure to check if they are checked off on your menu items. An easy way to do this is to hit the “view taxes” button on the top of your proposal. This will tell you which taxes and fees are applying to which menu items.